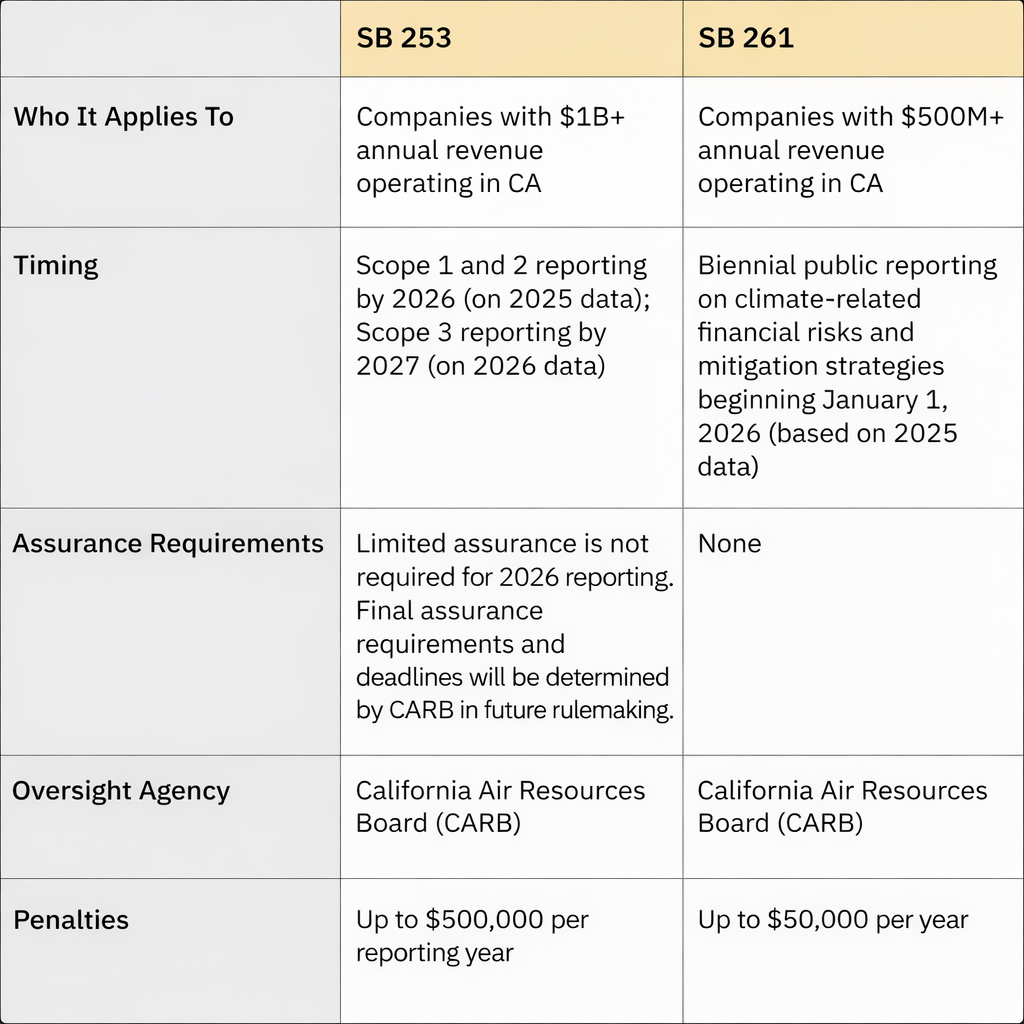

California has enacted two first-of-their-kind climate disclosure laws, SB 253 and SB 261, that will significantly impact thousands of companies doing business in the state.

- SB 253 requires U.S.-based companies with over $1 billion in annual revenue doing business in California to report their Scope 1 and 2 greenhouse gas emissions in 2026 and Scope 3 emissions starting in 2027 based on the prior fiscal year emissions. CARB’s proposed initial regulation would set a first-year Scope 1 and 2 reporting deadline of August 10, 2026.

- SB 261 mandates biennial public reporting on climate-related financial risks and mitigation strategies by companies with over $500 million in annual revenue, with an initial statutory deadline of January 1, 2026. However, CARB has stated it will not enforce SB 261’s January 1, 2026 deadline due to a Ninth Circuit injunction while the appeal proceeds; CARB plans to provide an alternate reporting date after the appeal is resolved.

Where California goes, the world often follows. The state is home to one of the world’s largest economies, and it has a history of driving national and global change. Its two new climate disclosure laws follow this trend, with a ripple effect that reaches well beyond the state’s borders.

In 2023, recognizing an urgent need to address the physical, human, and financial risks associated with climate change, California passed the Climate Corporate Data Accountability Act (SB 253) and the Climate-Related Financial Risk Act (SB 261). As a result, thousands of organizations that do business in California will now have to provide assurance-ready reports on their carbon footprints — including scope 3 emissions from up and down their value chains.

California’s Climate Disclosure Laws: A Timeline

Despite discussion of potential delays, deadlines for reporting under SB 253 and SB 261 remain firm. Here’s a quick timeline of key milestones to help you track California’s climate disclosure laws:

- October 2023: California Governor Gavin Newsom signs SB 253 and SB 261 into law. The California Air Resources Board (CARB) is charged with finalizing the requirements.

- July 2024: Newsom proposes a two-year delay, but by the end of the legislative session, SB 253’s implementation date (January 1, 2026) remains unchanged.

- September 2024: California passes an amendment bill, SB 219, with updates, including:

- Giving CARB until July 2025 to finalize implementing regulations for SB 253 (a six-month extension)

- Allowing CARB to decide whether to manage disclosures in-house or contract with a third party

- Permitting companies with subsidiaries to roll up data into a single parent-level disclosure

- A phased approach to scope 3 reporting, with submissions due later in the year than scope 1 and 2 reports

- May 2025: CARB holds a virtual public workshop to discuss implementation of SB 253, SB 261, and SB 219.

- CARB reiterates that timelines remain firm: January 1, 2026, for initial reports under SB 261, and 2026 (specific date to be determined by CARB) for SB 253

- CARB aims to publish draft regulations by the end of 2025 and indicates that it might take up to one year to complete rulemaking — meaning SB 253 implementation rules might not be finalized until late in 2026

- It is still TBD whether SB 261 will require formal regulations or if guidance will suffice (SB 253 explicitly requires CARB to adopt implementing regulations, but SB 261 does not)

- Continued public engagement and additional workshops are planned

- August 2025: CARB issues updated guidance on covered entities, exemptions, reporting timelines, fees, and minimum disclosure requirements.

- September 2025: CARB releases preliminary list of companies that may be impacted by SB 253 and/or SB 261.

- October 2025: CARB publishes draft reporting template for SB 253.

- November 2025: CARB hosts a new virtual workshop on November 18, 2025, to provide updates on the development of California’s SB 253 and SB 261 climate disclosure programs, including covered entities, proposed rule changes, and upcoming reporting deadlines.

- December 2025: CARB posts proposed initial regulation materials for SB 253/SB 261 (including a proposed first-year Scope 1 and 2 reporting deadline of August 10, 2026).

- December 2025: CARB issues an SB 261 enforcement advisory following a Ninth Circuit injunction and opens a public docket for voluntary submissions.

Key Reporting Deadlines

- SB 261: Reports must be published on company websites by January 1, 2026, and every two years thereafter (per statute). However, CARB has stated it will not enforce the January 1, 2026 deadline due to a court injunction during the appeal. CARB will provide an alternate reporting date after the appeal is resolved.

- Entities that choose to report voluntarily may submit a public link to CARB’s docket (Dec 1, 2025–July 1, 2026).

🎥 See how companies like DXC Technology are preparing for SB 253 assurance.

What Happened: California’s Climate Accountability Package

In October 2023, California Governor Gavin Newsom signed SB 253 and SB 261 into law. The bills were first introduced in January 2023 by a group of lawmakers seeking to enhance transparency, standardize disclosures, and provide stakeholders and consumers with transparent and credible climate information. The Climate Corporate Data Accountability Act (SB 253) passed the state Assembly in September 2023 in a 49-20 vote.

In the 2024 California legislative session, Governor Newsom proposed a two-year delay in the implementation of these laws, spurring discussions on whether companies would have additional time to prepare for the new reporting requirements.

Despite this discussion, the timeline for implementing the bills has remained unchanged. However, CARB was given a six-month extension (to July 1, 2025) to publish the official disclosure requirements for SB 253.

At CARB’s workshops and in its published materials, CARB has reiterated that statutory timelines remain firm. For SB 253, CARB’s proposed initial regulation would set a first-year Scope 1 and Scope 2 reporting deadline of August 10, 2026 (the statute requires reporting in 2026 but does not specify a date). For SB 261, while the statute sets an initial report date of January 1, 2026, the Ninth Circuit issued an injunction on November 18, 2025. CARB has stated it will not enforce the January 1, 2026 deadline while the appeal is pending and will provide an alternate reporting date after the appeal is resolved.

🎥 Are you ready for SB 253 & SB 261? Gain practical tips with our on-demand webinar featuring Albertsons.

Here’s what you need to know about the two policies:

SB 253: The Climate Corporate Data Accountability Act

The passage of SB 253 represents a milestone in the establishment of mandatory emissions reporting regulations. The law requires large public and private US-based organizations that do business in California to disclose their greenhouse gas emissions in accordance with the GHG Protocol. The policy applies to US-based partnerships, corporations, limited liability companies, and other entities with operations in California and annual gross revenue of more than $1B USD — an estimated 5,400 organizations.

Under the law, impacted companies will need to report their full carbon inventories, including scope 3 emissions. This is pivotal, as scope 3 emissions often account for more than 90% of an organization’s climate impact and are notoriously difficult to measure.

The Climate Corporate Data Accountability Act stipulates that companies may have to submit emissions calculations to a digital reporting platform and make disclosures easily comprehensible to residents, investors, and other stakeholders. Notably, companies will also be required to hire independent auditors to verify their reported emissions — making rigorous carbon accounting absolutely critical.

The California Air Resources Board (CARB) will oversee reporting and ensure verification of data by a registry or third-party auditor with expertise in carbon accounting. Companies that fail to comply with the new regulations could be subject to civil penalties from the state’s attorney general.

Companies will need to report on their 2025 direct emissions (scope 1) and indirect emissions from purchased energy (scope 2) in 2026; CARB’s proposed initial regulation would set a first-year reporting deadline of August 10, 2026. They will need to disclose their 2026 indirect scope 3 emissions starting in 2027. Notably, CARB has clarified that no penalties will be imposed in 2026 for SB 253 as long as companies demonstrate a "good faith effort" in preparing their disclosures.

SB 261: The Climate-Related Financial Risk Act

The Climate-Related Financial Risk Act (SB 261) requires large businesses to prepare and submit a biannual climate-related financial risk report detailing the physical and transition threats they face as a result of climate change, as well as the measures they’re taking to mitigate and adapt to those risks.

The bill applies to any US corporation or business entity with annual revenue over $500M USD that does business in California — a lower threshold than SB 253. Submissions will be reviewed by the Climate-Related Risk Disclosure Advisory Group, which will identify inadequate reports, as well as propose additional policy changes and best practices for disclosure.

According to its sponsors, SB 261 is modeled after existing climate disclosure rules used by the state’s teachers’ retirement fund (CALSTRS) and hundreds of major financial institutions. It aims to protect consumers and investors from losses due to climate-related disruptions to supply chains, workforces, and infrastructure, which are increasing as climate change worsens.

The bill also addresses the financial risks businesses could face if they are unprepared for the transition to a low-carbon economy. For instance, automobile manufacturers who fail to prepare for consumer demand for electric vehicles will likely experience a decline in market share, resulting in revenue losses.

Now that Governor Newsom has signed SB 261 into law, the initial round of climate risk disclosure reports is due by January 1, 2026 in statute, but CARB has stated it will not enforce that deadline while a Ninth Circuit injunction remains in effect and will provide an alternate date after the appeal is resolved.

Why It Matters

California’s climate disclosure package heralds a new era for corporate sustainability. Thousands of businesses will now have to publicly share their emissions profiles, which could lead to significant carbon reductions. The laws ratchet up the pressure on large corporations — the heaviest emitters of greenhouse gases — to decarbonize. Consumers and regulators will be able to readily identify companies that are falling behind and encourage them to take action. Moreover, the law will protect investors by exposing entities that are vulnerable to substantial climate-related financial risk.

Climate-forward companies stand to benefit from California’s policies. If an organization has already been measuring and mitigating its emissions and climate risks, the new reporting framework will allow it to showcase those initiatives.

Though the bills apply only to entities doing business in California, they reflect a global push for increased transparency in carbon accounting. This wave of climate disclosure laws includes the European Union’s Corporate Sustainability Reporting Directive (CSRD) and pending regulations from the US Securities Exchange Commission (SEC).

These developments answer demand from investors for the consistent, comparable, reliable climate information they need to make informed decisions. As a growing number of companies make commitments to net-zero emissions, enhanced transparency allows stakeholders to assess whether they are greenwashing or genuinely making progress toward these commitments.

Complying with California’s climate disclosure laws can also help companies build value. With accurate carbon data, teams can quickly identify hotspots such as high-emitting suppliers, along with opportunities to improve efficiency and reduce costs. The ability to provide investor-grade climate data can also help attract capital and create a competitive advantage: Many consumers are willing to pay a premium for sustainable brands and change their buying behavior to reduce their carbon footprints.

California’s new laws make it the first state in the US to require climate transparency at this level, and other states are already following suit. California is also a major player in global markets — it is rapidly moving up the ranks to become the world's fourth-largest economy, overtaking Germany. It has used its market muscle to push for global change before, most notably with its ambitious tailpipe regulations for automakers.

How did it happen?

In 2022, a bill similar to SB 253 faced a close call in the California Assembly, falling short by just one vote after opposition from powerful interest groups. Then the landscape shifted. In 2023, the coalition supporting disclosure ballooned, with heavy hitters like Microsoft, Apple, Adobe, Patagonia, and IKEA joining forces to endorse SB 253. At the same time, the intensity of disasters ravaging California fueled demand for climate action from impatient voters. Against this backdrop, more and more companies initiated voluntary disclosures, and a growing number of investors began demanding net-zero commitments and pushing for increased transparency about climate-related financial risks. This momentum helped push SB 253 and SB 261 over the finish line.

It's not surprising that Sacramento is leading the charge on corporate climate accountability. In the last decade, California has been hit hard by wildfires, floods, and other climate-related disasters. Without prompt measures to reduce greenhouse gas emissions, the state’s finances, economy, and environment are at risk.

🎥 Sign up and access our on-demand webinar: Answers to your top questions on California’s Climate Laws.

Prepare for GHG Emissions Reporting Under California's New Regulations

The world is rapidly shifting to a low-carbon economy, and California’s climate accountability laws will further speed that transition. Businesses can respond by creating an action plan for climate disclosure now.

If you’re a large company operating in California, you will need to begin gathering emissions data in 2025 to meet reporting requirements in 2026.

This data needs to be handled with the same level of care as your other financial data, which requires rigorous internal processes and controls. Persefoni’s carbon accounting platform ensures that your emissions calculations are traceable, transparent, and reliable. We help you efficiently build auditable, investor-grade reports, so you can confidently disclose under California’s laws — while preparing for future federal and global mandates.

Learn more about how Persefoni can help you get ready for SB 253 and SB 261.

SB 253 & SB 261 FAQs

Is SB 253 reporting delayed?

No. Despite Governor Newsom's proposal for a two-year delay during the 2024 California legislative session, the implementation date for SB 253 remains unchanged, with companies required to begin reporting in 2026. Although the California Air Resources Board (CARB) is still finalizing the disclosure requirements, businesses should not delay preparation. Organizations should begin calculating and reporting their emissions now using FY2025 data.

Who does SB 253 and SB 261 apply to?

Some companies may be subject to both laws.

Exemptions include nonprofits/tax-exempt charities, certain insurance-related entities, government entities (and majority-owned government entities), entities whose only California activity is teleworking employees, and entities whose only activity in California is wholesale electricity transactions.

What does “doing business in California” mean under SB 253 and SB 261?

CARB has proposed aligning with California Revenue & Taxation Code §23101 and defining “doing business in California” for this program as:

- actively engaging in transactions for financial gain (per §23101(a)); and

- meeting specific criteria under §23101(b), including being organized/commercially domiciled in California or exceeding the sales threshold (CARB’s FAQ notes that property and payroll tests are not included in staff’s proposed definition for these programs).

If we do little business in CA (below the revenue threshold) but exceed the benchmark globally, are we required we disclose?

The bill defines a “reporting entity” as a US-based entity with $1B USD in total annual revenue, not just revenue within the US. Please see SEC. 2, Section 38532 of the bill text. Further detail as to the interpretation of “reporting entity” and other definitions in the bill are expected to be fleshed out in the implementing regulations to be adopted by CARB.

When are the first disclosures due?

- SB 253:

- Scope 1 & 2 GHG emissions must be reported in 2026 (using FY2025 data). CARB’s proposed initial regulation would set the first-year reporting deadline as August 10, 2026.

- Scope 3 emissions reporting begins in 2027 (based on FY2026 data).

- Assurance: Companies will not need to perform limited assurance in 2026. Final timelines and requirements are yet to be determined by CARB in future rulemaking

- SB 261:

- Climate risk reports are due January 1, 2026 in statute, and then every two years. CARB has stated it will not enforce the January 1, 2026 deadline due to a court injunction and will provide an alternate date after the appeal is resolved.

What kind of assurance is required?

- SB 253:

- Scope 1 & 2 emissions require limited assurance beginning in 2026

- Reasonable assurance is required by 2030

- Scope 3 may require limited assurance by 2030, subject to market readiness (CARB may accelerate this requirement to 2027 if feasible).

- SB 261 does not currently require third-party assurance, but disclosures must be complete, specific, and decision-useful.

Where do SB 261 reports need to be submitted?

SB 261 reports must be published on a company’s website. In addition, companies must post the URL to their report in a public docket that CARB will open on December 1, 2025, and keep open until July 1, 2026.

Can we use our parent company’s emissions report if it’s based outside the U.S.?

Yes, it is expected that this will be accepted as long as you are including the emissions from the subsidiary doing business in CA as well. Keep in mind that only US entities are in-scope, so you’ll need to evaluate whether the parent or the subsidiary is in scope first.

Will the inaugural 2026 SB 261 report need to cover 2024 and 2025? And each biannual report thereafter with a two-year look back?

CARB has stated that companies may use data from FY2023–2024 or FY2024–2025 in their initial SB 261 disclosures, depending on availability. Reports will be required biennially after that.

What fees will companies pay?

CARB is developing a fee regulation that would assess annual fees on reporting entities (SB 253) and covered entities (SB 261). The proposed regulation establishes a framework for calculating fees annually and includes CPI-based adjustments starting after the base year. Specific fee amounts are not fixed in statute and would be set through CARB’s fee program.

What measures / fines are in place for non-What are the penalties for non-compliance with SB 253 or SB 261?

- For SB 253 penalties are defined as up to $500,000 per year. There is a Scope 3 safe harbor if disclosures are made in good faith with reasonable basis

- For SB 261, penalties are defined as up to $50,000 per year

- CARB has referenced its December 2024 Enforcement Notice, clarifying that no penalties will be imposed in 2026 for SB 253 as long as companies demonstrate a "good faith effort" in preparing their disclosures.

Will SB 253 impact small businesses?

Companies under $1B USD in revenue will not be directly subject to California SB 253. However, we expect that the inclusion of scope 3 in the law will lead to increased pressure throughout value chains for scope 1 and 2 emissions disclosures, as these help larger companies report on scope 3. Many large companies already report their scope 3 emissions, with minimal reported burden on small businesses.

What should companies do now to prepare?

- Start collecting emissions data aligned to GHG Protocol standards (for SB 253).

- Identify and assess material climate-related risks using the TCFD framework (for SB 261).

- Build internal collaboration between sustainability, finance, legal, and risk teams.

- Invest in technology that ensures transparency, auditability, and data ownership.

- Document your processes, assumptions, and any data limitations to support a good faith compliance posture.